The Task Force on Climate-related Financial Disclosures (TCFD) was set-up by the G20 to develop voluntary, consistent climate-related financial risk disclosures for use by companies in providing information to investors, lenders, insurers, and other stakeholders. The UK has recently become the first country in the world to make TCFD aligned disclosure mandatory for premium-listed companies. This will start with a ‘comply or explain’ requirement by 2023, with full mandatory reporting expected by 2025.

What is TCFD?

Launched by the G20 Financial Stability Board to provide climate reporting guidelines for companies, the TCFD is a set of reporting recommendations that enable companies to monitor and reduce the risks associated with climate change. It provides companies with a method for incorporating climate change into their business plans by integrating strategy and climate scenario analysis into the financial risks identified by the company.

The Task Force will consider the physical, liability and transition risks associated with climate change and what constitutes effective financial disclosures across industries.

Unlike other recent reporting developments, TCFD isn’t about your impact on the environment, it is about the environment’s impact on you. These disclosures are targeted at mainstream investors, and are intended to help them assess whether climate risk is appropriately priced in to their valuation of your company.

Who Reports?

For reporting purposes, TCFD applies to:

- organisations from both the financial and nonfinancial sectors

- increasingly other frameworks are including the recommendations and encouraging to align their disclosures with them.

- especially relevant for those with annual revenue above US$ 1 billion.

- asset managers and owners looking to better understand risk and how this affects their investments.

What is Reported?

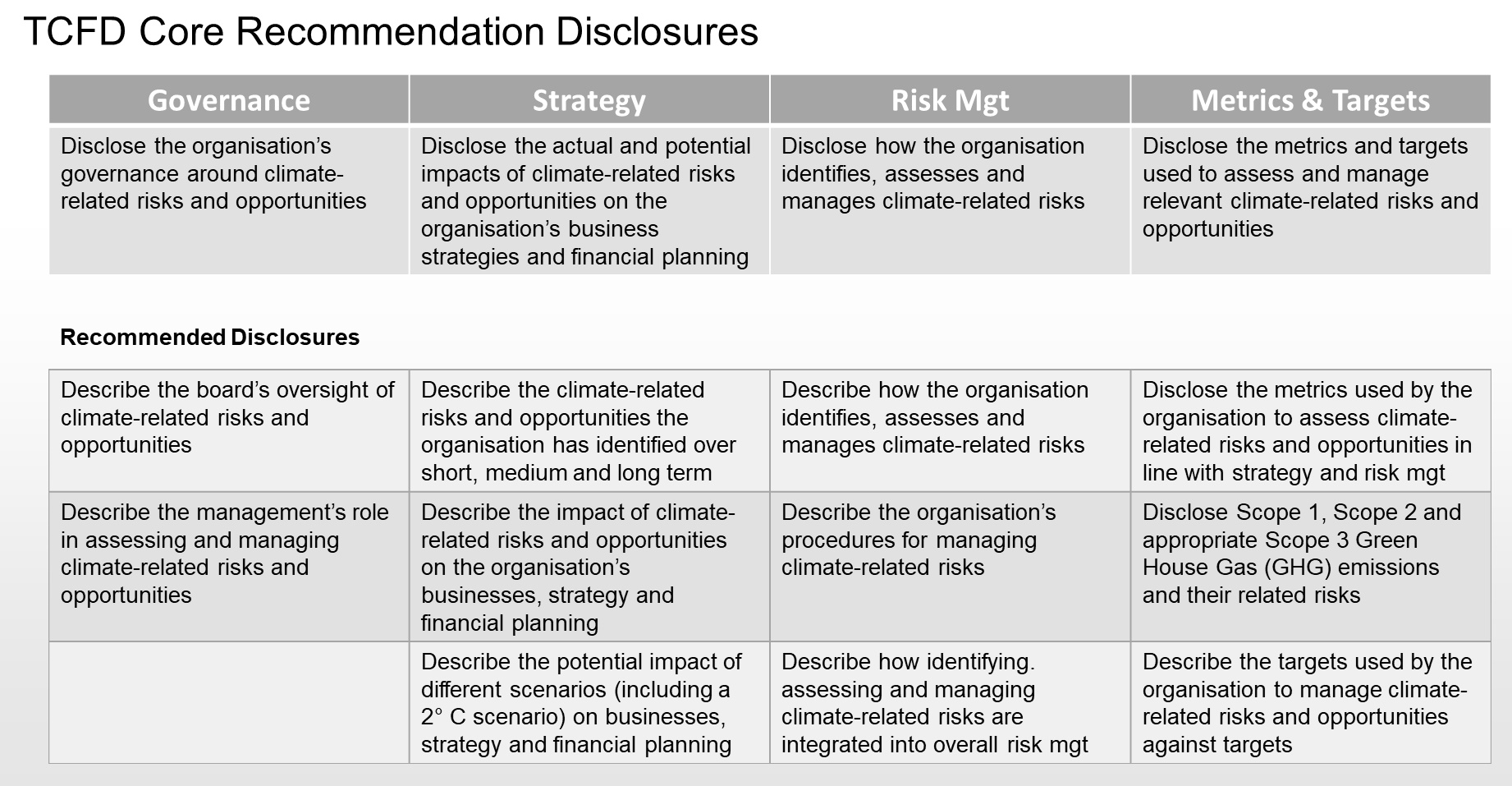

There are four key areas for TCFD reporting, as shown in the diagram below:

Governance

Is climate change governance defined and sufficient at all hierarchical levels, especially at the highest level?

Strategy

What are the impacts (actual and potential) of climate-related risks and opportunities on business strategy and financial planning? How resilient is the business strategy under various climate scenarios, including the 2°C scenario?

Risk management

How to identify and manage climate-related risks and opportunities within the company? How does this approach fit with the general risk

management of the company?

Measures and Objectives

What indicators and targets should an organisation use to measure and manage climate-related risks and opportunities? What are

the company’s emissions on Scopes 1, 2 and 3?

Recommended Disclosures

The diagram below summarises the recommended disclosures under TCFD: